Rates explained

Rates are contributions made by almost every property in the Borough of Queenscliffe to the upkeep of infrastructure and services in our community.

Council collects these contributions and invests them in things like roads, library services, and public parks. When you visit a playground, walk along the footpath or receive a visit from one of our community care workers, you’re seeing your contribution at work.

What Charges are included in the Annual Valuation & Rate Notice

- General Rates: A property tax based on the property's value to fund various services provided by Council.

- Waste Management Charges: Fees for the collection and disposal of waste.

- Emergency Services and Volunteer Fund: A levy to support the State Government’s emergency services.

- Any concessions that may apply (e.g. Pensioner’s concession).

How general rates are calculated

- First Council calculate the total amount of rate revenue need to maintain Council’s services . The amount is capped by the Minister for Local Government, limiting the amount councils can increase their total revenue from general rates.

- Then total rates revenue required is divided by the total value of the ratable properties within the Borough of Queenscliffe, the resulting figure is referred to as the rate in the dollar (this figure changes every year).

- Council then multiply the rate in the dollar by the capital improved value (market value) of a property to determine the amount of general rates apply to that property.

Example:

- For the 2025-26 financial year, $7.2 million total rates revenue divided by the total value of the ratable properties within the Borough of Queenscliffe, Council has arrived at rate in the dollar value of 0.00169837 for a residential property

- To calculate general rates payable by a residential property with $1.0 million capital improved value

- Council multiply $1,000,000 by 0.00169837 to get a 'general rate' of $1,698.37

The following YouTube video provides a good overview of how rates are generally calculated. To watch, click on the thumbnail below.

For more rates FAQS please visit the Local Government Victoria website.

Under the general rates calculation methodology outlined above, changes in individual property values do not affect the total amount of rates collected by Council each year. Instead, the total amount is determined by the annual rate cap set by the Minister for Local Government.

Each property in the Borough contributes a proportion of this total amount, based on its value as assessed by the Valuer General Victoria. Properties that increase in value significantly more than others will contribute a larger share, while those that increase less or even decrease may contribute a smaller share of the total rates.

Example:

- The total ratable value of residential properties in the Borough of Queenscliffe has declined by an average of 7.5% for the 2025–26 rating year.

- Council has increased total rates revenue by 3% for the 2025–26 rating year, in line with the rate cap set by the Minister for Local Government.

- If a residential property’s value has decreased by 7.5%, in line with the average across the municipality, it will see a 3% increase in rates for 2025–26.

- If a property’s value has decreased by more than 7.5%, it will experience less than a 3% increase in rates, or possibly a reduction.

- If a property’s value has decreased by less than 7.5%, it will experience a rate increase greater than 3%.

- Properties that have increased in value may see a more substantial increase in rates for the 2025–26 financial year.

- Overall, a rates increase of more than 3% for some properties will be offset by smaller increases or reductions for others, ensuring that Council’s total rates income remains unchanged apart from the 3% increase allowed under the rate cap.

Waste Manegement Charges

Please refer Council’s Annual Budget and Council Policy CP038: Waste Management for information.

Emergency Services and Volunteer Fund (State Government Charges)

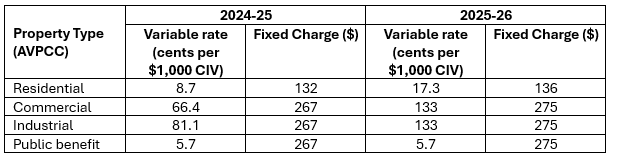

The Emergency Services and Volunteers Fund (ESVF) has been introduced by the Victorian Government to replace the Fire Services Property Levy. Under the new Fire Servies Property Amendment (Emergency Services and Volunteers Fund) Act 2025, Council must collect the ESVF on behalf of the Victorian Government. As summarised in the table below, the 2025–26 rating year includes increases in both the fixed rate and the variable rate applicable to each property type based on the Australian Valuation Property Classification Code (AVPCC).

Each property is allocated an AVPCC by the Valuer General Victoria which is used to determine land use classification for the ESVF.

Please refer to Emergency services and volunteers fund | State Revenue Office for general ESVF information and calculator. Volunteer rebate information can be found at Eligible Volunteers Rebate Scheme | Service Victoria. Support is also available on the ESVF Support Line 1300 819 033.

Revenue collected through the Emergency Services and Volunteers Fund (ESVF) is paid into the State’s Consolidated Fund and then directed to support emergency services, similar to the previous Fire Services Property Levy (FSPL).

Each year, the Government estimates how much revenue the ESVF will raise, as published in the State Budget, with limits set by legislation to ensure no more than a set proportion of each service’s budget is collected through the levy. The actual amounts for each service are confirmed and published in the Government Gazette by the end of May each year. For 2025–26,these amounts can be viewed here.

These published amounts do not include additional government contributions, ad hoc funding, or administration costs associated with the levy and volunteer offset scheme. Full details of total government funding received by emergency services are reported in each organisation’s Annual Report.

(Source: State Revenue Office)

Concessions/Rebates

The Borough of Queenscliffe also provides some discounts on rates. Pensioners in the Borough receive one of Victoria’s highest discounts on their rates of $150 per eligible ratepayer property, above that funded by other levels of government.